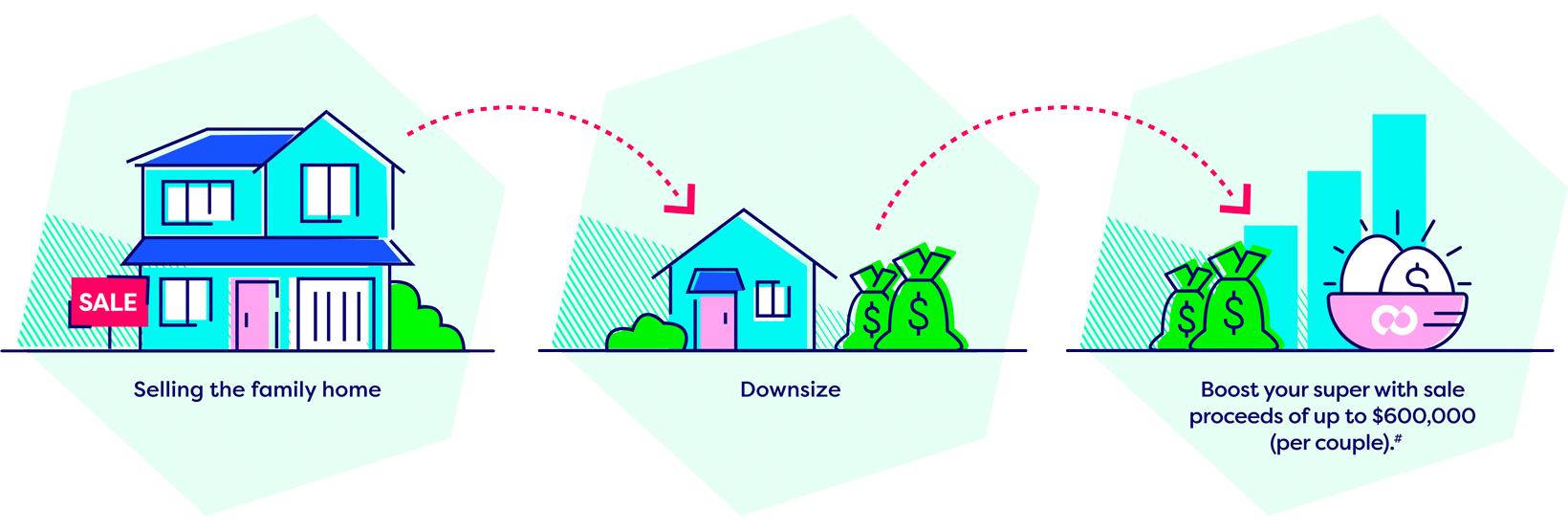

Downsizing your home

Selling your family home and contributing all (or some) of the sale proceeds to your super account, can be a great way to give your super a boost before you retire.

Benefits

Downsizing your life can help upsize your super – so you may have more money when you retire. There are a few benefits to this type of contribution:

Contribution caps don’t apply

It doesn’t matter how much you have in your super, contribution caps don’t apply for downsizer contributions.

Tax benefits

No tax when you contribute it, and if you invest it into a pension there’s no tax on investment earnings and no tax when you withdraw it once you turn age 60

No work test requirement

You can make this contribution anytime from age 55 regardless of whether you are working or not.

How it works

- You must be 55 or over

- You must have owned your home for 10 plus years

- You can contribute up to $300,000 individually (or $600,000 as a couple)

- Contribution must hit your super account within 90 days of the settlement.

- It was your primary residence (i.e. exempt or partially exempt from Capital Gains Tax)

- You must complete the ‘Downsizer contribution into super form’ and provide it to your fund before or at the time you make the contribution. This form is available from the ATO here

- It could impact on your eligibility for the government Age Pension.

How much difference can it make?

Janelle is a single mum aged 55 and wants to downsize. If she decides not to make a downsizer contribution, her income in retirement will be $38,000 per annum.

Let’s see what her retirement income will be if she makes a downsizer contribution:

| Contribution | Income in retirement | Extra income |

|---|---|---|

| $150,000 | $46,000 per annum | $8,000 per annum |

| $300,000 | $52,000 per annum | $14,000 per annum |

Assumptions: Janelle has starting salary of $87,000 and starting balance of $92,000. She makes downsizer contribution at 55 and retires at age 67. Her super is invested in the Balanced option 5.5% (after fees but before taxes). Retire at age 67 starting an income stream invested in the Balanced option 5.5% (after fees but before taxes). Her aim is for her super to last up until age 92 (Life Expectancy + 5 years). Income is in today’s dollars. CPI – 2.5%. Salary and contributions indexation – 2.5%. AWOTE – 4%. Age pension rates as of August 2023

#Up to $300,000 for singles.

How to make a downsizer contribution

To make a downsizer contribution complete the Downsizer contribution into super form from the ATO. Return your completed form to us before you make your super contribution via BPAY or cheque. Depending on the size of your contribution, if you plan to pay via BPAY you may need to increase your daily transfer limit through your bank. If you make more than one contribution, you’ll need to provide a form for each one.

All downsizer contributions be made within 90 days of receiving the sale proceeds from your home. You may be eligible to apply to the ATO for an extension of time in some circumstances.

For all the T&Cs, check the ATO website.

Get help

You can speak with a Financial Planner from CareSuper about how to make a downsizer contribution into your account. You can request a call here. Creating fantastic retirements is our passion at CareSuper, so if you need some help planning your best retirement, please give us a call.

A downsizer contribution is a type of non-concessional superannuation contribution, however it doesn’t count toward the non-concessional cap. You can make a downsizer contribution of up to $300,000 ($600,000 per couple) from the sale proceeds of your family home.

You can make a downsizer contribution of up to $300,000 ($600,000 in total for couples) if you’re age 55 or older and meet all other eligibility requirements. The work test does not apply to downsizer contributions, there is no upper age limit.

The reason you might consider making a downsizer contribution is to boost your super balance for your retirement, following the sale of your family home.

The main benefits of making downsizer contributions are tax incentives, that they don’t count toward the non-concessional contributions cap, and that you can contribute regardless of whether or not you’re still working – there is no upper age limit.

Further detail on the benefits as follows:

- Potential tax benefits: including no tax payable when you make the contribution, and if you move it to an account-based pension you won’t pay tax on investment earnings

- It’s a non-concessional contribution, but doesn’t count toward the con-concessional cap

- The work test doesn’t apply: so you can make this type of super contribution from age 55, and after age 75, whether or not you’re still working.

It’s a good idea to seek financial advice before you make a downsizer contribution, to make sure it’s right for your circumstances. You have access to financial advice as part of your membership.*

You must make you downsizer contribution to your superannuation account within 90 days of receiving the sale proceeds.

You or your partner need to have owned the property continuously for at least 10 years. While you don’t have to have lived in the property for the full 10 years, it must meet the rules to be classified as your ‘main residence’ for an exemption under capital gains tax (CGT) rules.

You can’t make any further contributions to a pension account once it has been opened. You would need to either contribute the money to an accumulation account or start a new pension account.

Give us a call on 1300 360 149 if you need help with downsizer contributions – we can talk you through your options.

Yes, both you and your partner can make a downsizer contribution following the sale of your home. This is the case as long as the combined value of your two contributions will not exceed the sale price and the spouse that didn’t have an ownership interest meets all the other requirements.

Give us a call on 1300 360 149 if you need help with downsizer contributions – we can talk you through your options.

You will be able to take advantage of the downsizer contribution rules once you sell an eligible home, regardless of whether you make a subsequent home purchase.

You don’t have to be married to take advantage of the downsizer contribution rules. As a single person you can contribute up to $300,000 under the downsizer rules, and as a couple, regardless of whether you’re married or in a de-facto relationship, you can contribute up to $600,000 (a maximum of $300,000 each).

Downsizer contributions are used in the means (asset) test for the Age Pension.

If you currently receive the Age Pension, it’s a good idea to get financial advice before making a downsizer contribution to your super to see how it might affect your entitlements. You have access to financial advice to sort your super at no extra cost, it’s part of your membership.*

If you’re over age 55 you can make a downsizer contribution regardless of whether or not you’re still working. However, you must have an accumulation account to make your downsizer contribution. If you’re retired and have started an account-based pension, you’ll need to start a new pension account.

*Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766.

Discover why around 220,000 members choose CareSuper^