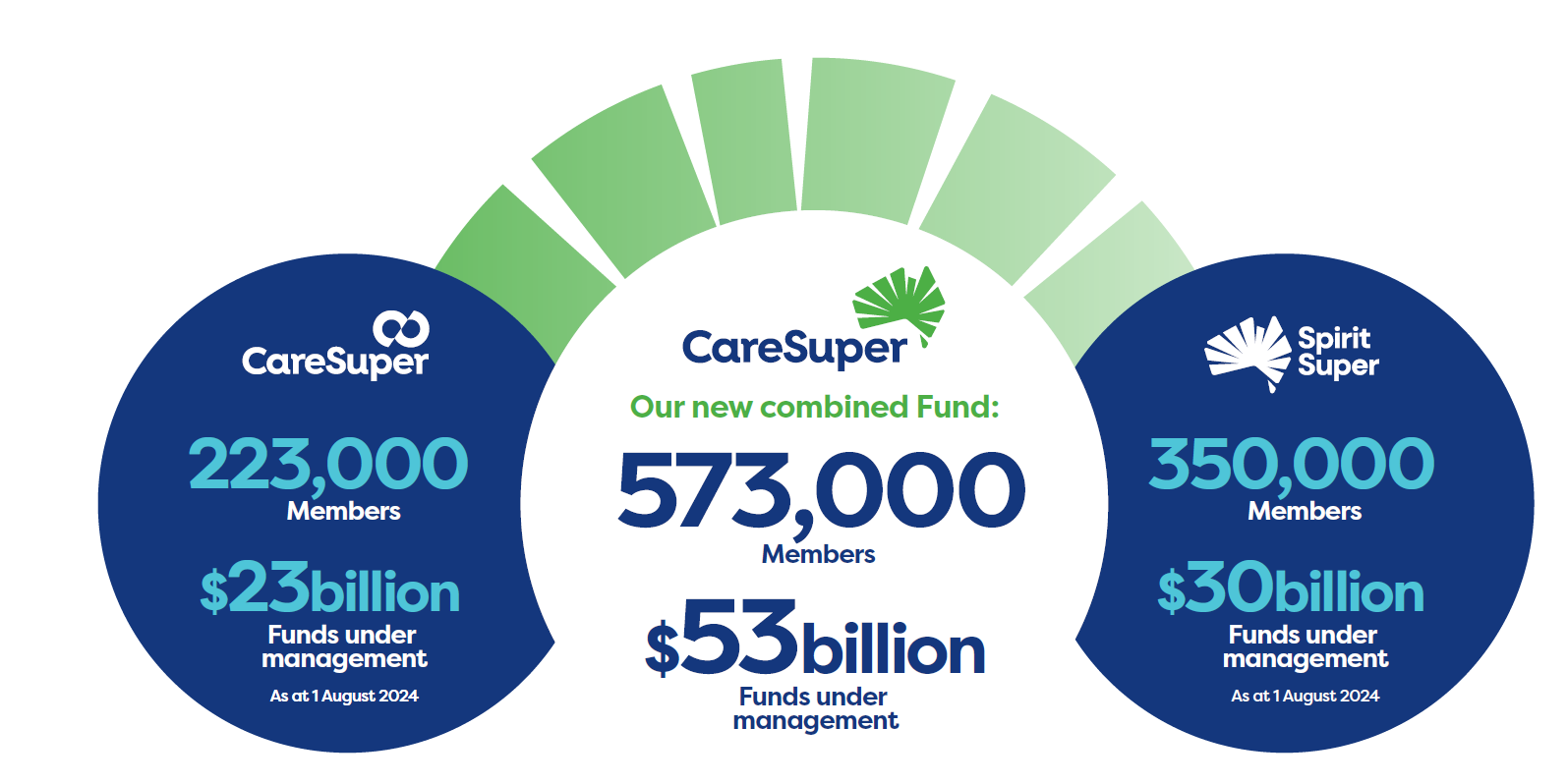

CareSuper and Spirit Super merger update

CareSuper and Spirit Super merger update

We’re excited our merger with Spirit Super is happening soon. This means you’ll benefit from an exciting range of innovative products, award-winning service and a focus on real care to help you retire with confidence. You’ll find everything you need to know about the merger here and you can also register for a merger webinar or watch a super webinar recording or pension webinar recording.

What to expect as we transfer your account

There are a few key times where you’ll hear from us as we transfer your account into the merged fund; which will be called CareSuper. Below are the important milestones along the way as we complete the merger.

Service transition period

As we merge our data, there will be a pause on activity. We’ll work hard to minimize disruptions, but there will be some scheduled downtime. While we do this, you can rest assured, your super is safe and remains invested for your future. See the video below for details on the limited service period or find out more here.

Key dates:

| 22 October | Limited Service period begins |

| 21 November | Limited Service period ends |

The new fund will be called CareSuper.

The merger is on track to take effect from 1 November 2024. While your account will have transferred, there will be a period where you won’t have access to your online account and certain transactions. Read more about the service transition period below.

Your client ID will become your new member number. This is what you you’ll use to log into Member Online.

After the merger you’ll be provided with a new account number. You’ll receive this information in your welcome letter. If you have multiple accounts each account will have a different account number.

No, you don’t need to let your employer know about your new account number. Employers can continue to use your current ‘Client ID’, which will be known as your ‘member number’ in the merged fund. We also use other identifiable information to allocate contributions to members’ accounts, so contributions should still be paid correctly.

If you change jobs while the merger is happening, you can still remain with CareSuper and have your new employer make contributions to your account.

There will be a new choice of fund form available from 1 November 2024 on the website caresuper.com.au.

Otherwise your balance will transfer to the new fund and continue to remain safely invested for your future.

To ensure your employer pays your super contributions correctly, you can advise them contributions need to be:

- received by CareSuper before 22 October: using our current USI and ABN

- from 1 November: using our new USI and ABN.

All these details can be found at ID numbers.

Rest assured we have been proactively communicating with employers regarding the recommended early payment date and service transition period, as well as the change to our USI and ABN. You find more info here.

To facilitate the merger, a Limited Service Period (LSP) will be in place from 22 October 2024 to 21 November 2024. This will allow time for all member account details, data and administration services to be transferred to the merged fund. During this time there will be some scheduled disruption to processing that we’re working hard to keep to a minimum. Learn more about the limited service period here.

Yes, Member Online will be available as usual up until 5pm on 22 October 2024.

From 22 October until 31 October, you’ll still be able to log into Member Online, but you’ll only be able to view details (i.e. read only).

Member Online will be temporarily inactive between 1 November and 20 November but you can call us if you have any queries.

From 21 November a new Member Online experience will be available. CareSuper members will need to set a new password.

You can continue to contact us on 1300 360 149 or log a request on our website.

We’ll be able to provide general advice on your super up to the merger.

If you need more personal advice on your super, you can contact us as noted above and we’ll be in touch with you after the merger to arrange a meeting.

If you need personal advice that looks at your broader situation, you can contact us as noted above and we’ll have someone from the comprehensive advice team contact you to discuss next steps and any fees that may apply.

No your investments are not changing. This means that for most members, your current account balance and future contributions will continue to be invested in the same way as your current investment selections. The one exception is if you are invested in Capital Guaranteed this will be closed and your money will be moved into the Cash option. The Significant Event Notice will give more details on this. You can make an investment switch online by 5pm on 22 October.

From 1 November – 20 November – you can make an investment switch but will need to fill in a paper form available at caresuper.com.au. The switch will be processed effective the date it is received by the merged fund.

From 21 November you can register for your online account by resetting your password and then continue to make investment switches online.

For members in the employee and personal plan, the amount of insurance and the net cost of the insurance you have on 31 October 2024 will continue under the legacy insurance arrangements in the merged fund. If you apply to adjust your insurance (by increasing or decreasing your cover after 1 November 2024), the legacy insurance arrangements and associated costs will continue to apply to your cover, until your cover ceases or we advise you in writing. If you cease to hold legacy cover, you won’t be eligible for it again, however you may be eligible for CareSuper insurance cover under a different category.

If you’re part of a corporate insurance arrangement (CIA), your insurance cover will change from 1 November 2024 and we’ll explain these changes in your Significant Event Notice.

Your SEN has more details on how insurance will transfer to the new fund.

Yes there are changes to pension accounts. These are detailed in your Significant Event Notice and you can find out about the changes here.

-

1Read your SEN

Your SEN has information on all the changes to your account. Sign up for a webinar to learn more and ask questions.

-

2Understand the service transition period

Complete any transactions before the limited service period starts 22 October.

-

3Sit back and relax

We’ll automatically transfer your super. Your super remains invested for your future.

Merged Fund details

There are the important details you’ll need from 1 November 2024. Your employer needs the new USI number to make contributions into the new fund from 1 November 2024.

| Australian Business Number (ABN) – fund | 74 559 365 913 |

| Unique Superannuation Identifier (USI) | MTA0100AU |

| Contact centre | 1800 005 166 8am – 7pm AEST/AEDT weekdays Overseas call +61 3 7042 2723 |

Changes to responsible investing

The merger will introduce changes to our approach to responsible investing and environmental, social and governance (ESG) considerations, including changes to exclusions.

Significant event notices

Download the relevant significant event notice which will provide details on the changes to your account.

*Spirit Super was ranked best in super by Customer Service Benchmarking Australia (CSBA) for the period April 2023 to March 2024. Spirit Super has an agreement with CSBA for quality assurance and staff training within their contact centre. Awards and ratings are only one factor when deciding how to invest your super. Read about the award methodology at csba.com.au.