About the merger - FAQs

Merging two funds can be a lengthy process and we want to keep you updated throughout, so we've compiled some questions and answers below with the most recent information. We’ll write to members closer to the date with details about the new fund.

The new fund will be called CareSuper.

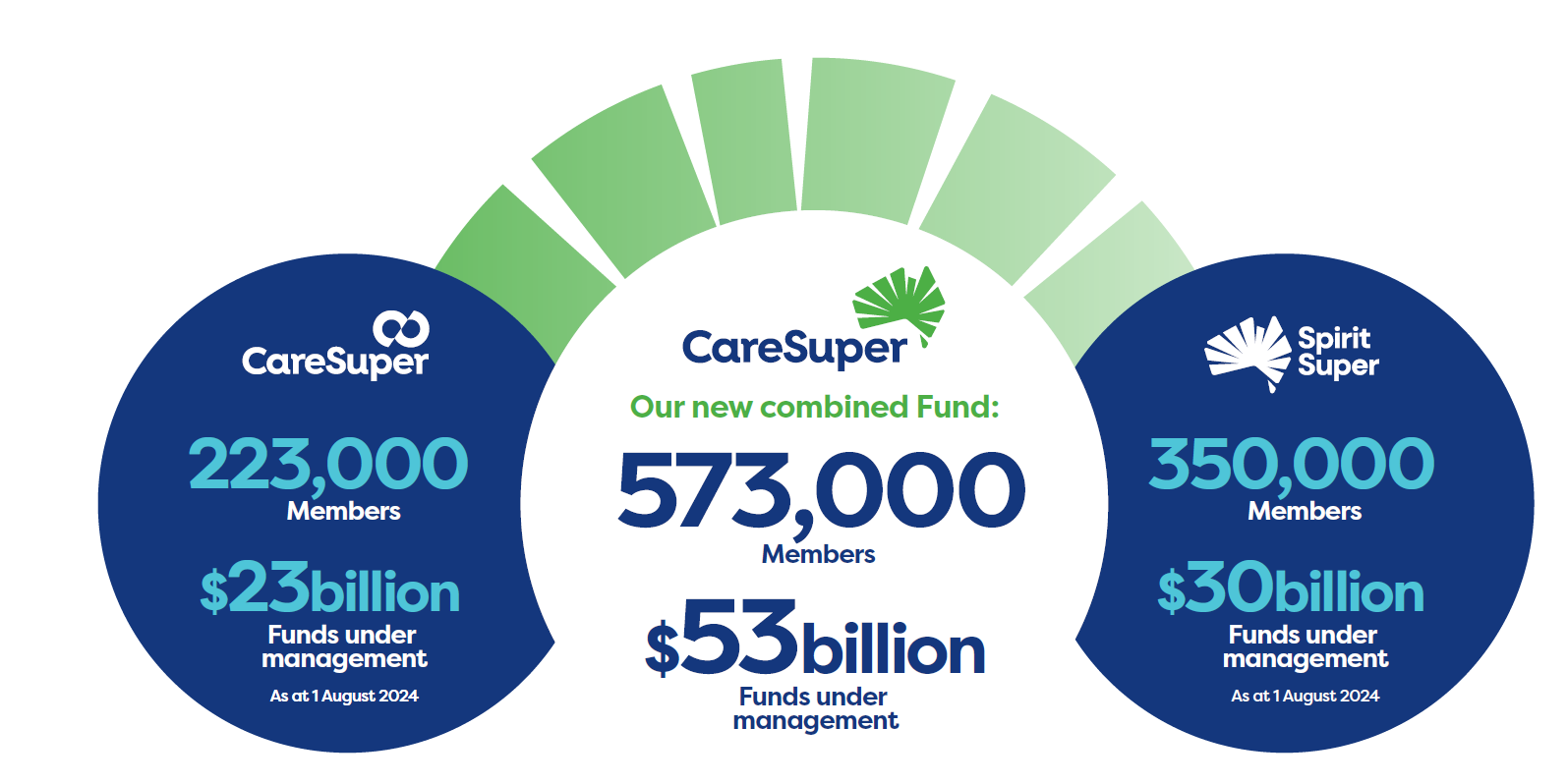

Spirit Super is an industry fund that was established in 2021 through the merger of Tasplan and the Motor Trades Association of Australia Superannuation Fund. As the fund for hard-working Australians, with a focus on growing membership in regional Australia, Spirit Super has over 350,000 members and $30 billion in funds under management.

The merger is on track to take effect from 1 November 2024. While your account will have transferred, there will be a period where you won’t have access to your online account and certain transactions. Read more about the service transition period.

Combining the two funds will offer additional scale which will allow the fund to continue developing the best possible offer for our members. Both are highly regarded, award-winning and high-performing super funds who share a vision to leverage the strengths of each. After a significant amount of consideration and due diligence, we’re confident that it will serve our members’ best financial interests.

No you don’t need to do anything for your account to be transferred to the merged fund. Your super will remain safely invested for your future.

There is a period where you won’t be able to access your account. You should visit the Service transition page for more details on any activities you should complete before 22 October which includes things like investment switches and requesting payments. See here for more information.

Your client ID will become your new member number. This is what you you’ll use to log into Member Online.

After the merger you’ll be provided with a new account number. You’ll receive this information in your welcome letter. If you have multiple accounts each account will have a different account number.

You can make changes to your account until 22 October. After this your Member Online account will be read only. You should make changes prior to this date. After this date you can make changes via a paper form from 1 November but you won’t be able to see the reflected changes until they have been processed in your new account. We’ll start processing again from 21 November and prioritise requests by the date received. See this page for more information on the Limited Services period.

Yes, Member Online will be available as usual up until 5pm on 22 October 2024.

From 22 October until 31 October, you’ll still be able to log into MOL, but you’ll only be able to view details (i.e. read only).

MOL will be temporarily inactive between 1 November and 20 November but you can call us if you have any queries.

From 21 November a new Member Online experience will be available. CareSuper members will need to set a new password to start using Member Online

If you make post-tax contributions by BPay or Direct Debit you will need to set these up again . We won’t be accepting Direct Debit amounts after 22 October. You will receive a new BPay number when you receive your welcome letter.

Employer contributions and salary sacrifice contributions will continue, however the USI number your employer uses to make the contribution is changing. The USI number which is used by employers to pay your super contributions, will change from 1 November 2024 to MTA0100AU. You may need to advise your employer of the new number because after 1 November, any contributions made to the old USI will be rejected.

ALL employers will need to use the new USI from 1 November.

From 1 November 2024 the USI number will change to MTA0100AU.

If you change jobs while the merger is happening, you can still remain with CareSuper and have your new employer make contributions to your account.

There will be a new choice of fund form available from 1 November 2024 on the website caresuper.com.au.

Otherwise your balance will transfer to the new fund and continue to remain safely invested for your future.

You can continue to contact us on 1300 360 149 or log a request on our website.

We’ll be able to provide general advice on your super up to the merger.

If you need more personal advice on your super, you can contact us as noted above and we’ll be in touch with you after the merger to arrange a meeting.

If you need personal advice that looks at your broader situation, you can contact us as noted above and we’ll have someone from the comprehensive advice team contact you to discuss next steps and any fees that may apply. After 1 November please call 1800 005 166 to book in to speak with a Financial Adviser.

The significant event notice you were sent contains all the information you need about the changes to your account. You can also call us, but we could experience high call volumes during the transition.

The merger hub contains a lot of information around the merger. We will be back to normal services from 21 November.

You can continue to call us. We could experience high call volumes but we will endeavour to get to you as soon as we can.

For questions about your account please call:

Before 1 November: 1300 360 146

From 1 November: 1800 005 166

No your investments are not changing. This means that for most members, your current account balance and future contributions will continue to be invested in the same way as your current investment selections. The one exception is if you are invested in Capital Guaranteed this will be closed and your money will be moved into the Cash option. The Significant Event Notice will give more details on this. You can make an investment switch online by 5pm on 22 October.

From 1 November – 20 November – you can make an investment switch but will need to fill in a paper form available at caresuper.com.au. The switch will be processed effective the date it is received by the merged fund.

From 21 November you can register for your online account by resetting your password and then continue to make investment switches online.

For members in the employee plan, the amount of insurance and the net cost of the insurance [BL1] you have on 31 October 2024 will continue under the legacy insurance arrangements in the merged fund. If you apply to adjust your insurance (by increasing or decreasing your cover after 1 November 2024), the legacy insurance arrangements and associated costs will continue to apply to your cover, until your cover ceases. If you cease to hold legacy cover, you won’t be eligible for it again, however you may be eligible for CareSuper insurance cover under a different category.

Your Significant Event Notice has more details on how insurance will transfer to the new fund.

This may be because the USI number which is used by employers to pay your super contributions, will change from 1 November 2024 to MTA0100AU. You may need to advise your employer of the new number because after this date, any contributions made to the old USI will be rejected.

ALL employers will need to use the new USI from 1 November.

From 1 November 2024 the USI number will change to MTA0100AU.

Past performance is never an indication for future performance. With or without merger we can never guarantee performance won’t change. The investment philosophy and strategy of the current CareSuper team will continue into the new fund. As a CareSuper member, you continue benefit from our dual investment approach. We actively manage your super, taking advantage when markets rise. But we also protect your super during volatile times. The result? A smoother ride to your life after work.

We invest (now and will continue after the merger) with one goal in mind: to help you achieve your best possible lifestyle when you wind-down from work. We use an actively managed and long-term strategy – driven by a proven investment philosophy to deliver a smoother ride for your super. Plus, our team of experts are always looking for ways to boost your returns.

Administration fees are decreasing. You can see all the new fees in the Significant Event Notice. The table below shows the fees for the Balanced option. See the SEN for full details on fees.

Super members

| Fees and costs | Current amount | Amount from 1 November | ||

| Administration fees and costs2 | $78 per year 0.19% of your account balance, per year (up to a $750 annual limit) 0.07% per year (paid from fund assets)3 | $67.60 per year 0.15% of your account balance per year (up to a $750 annual limit) 0.08% per year (paid from fund assets)4 | ||

| Investment fees and costs (estimated)5 | Investment option | % of the option’s assets per year | Investment option | % of the option’s assets per year (estimated)6 |

| Balanced | 0.66% | Balanced | 0.56% | |

| Transaction costs (estimated)5 | Investment option | % of the option’s assets per year | Investment option | % of the option’s assets per year (estimated)6 |

| Balanced | 0.05% | Balanced | 0.06% | |

Pension members

| Fees and costs | Current amount | Amount from 1 November | ||

| Ongoing annual fees and costs1 | ||||

| Administration fees and costs2 | $78 per year 0.19% of your account balance per year (up to a $750 annual limit) 0.07% per year (paid from fund assets)3 | $67.60 per year 0.10% of your account balance per year (up to a $750 annual limit) 0.08% per year (paid from fund assets)4 | ||

| Investment fees and costs (estimated)5 | Investment option | % of the option’s assets per year | Investment option | % of the option’s assets per year (estimated)6 |

| Balanced | 0.67% | Balanced | 0.5 | |

| Transaction costs (estimated)5 | Investment option | % of the option’s assets per year | Investment option | % of the option’s assets per year (estimated)6 |

| Balanced | 0.04% | Balanced | 0.0 | |

1 If your account balance is less than $6,000 at 30 June each year or when you close your account, certain fees and costs charged to you in relation to administration and investments are capped at 3% of the account balance. Any amount charged in excess of that cap must be refunded.

2 You pay these fees monthly or on withdrawal. Fees are calculated and deducted directly from your super account.

3 Based on the information available to us at the date of preparation of this SEN about CareSuper’s experience for the financial year ending 30 June 2024. The actual percentage for the 2023/24 financial year won’t be known until September 2024 and will be published on our website when available, if not materially adverse.

4 Amounts deducted from reserves are generally disclosed based on the experience for the prior financial year. For CareSuper for the 2023/2024 financial year this was 0.07%. We estimate this will not reflect the amounts deducted from reserves for the merged fund. The forward-looking estimated figure shown is based on information available to us at the date of preparation of this SEN about the merged fund’s estimated experience for the financial year ending 30 June 2025. The actual percentage for the 2024-25 financial year will not be known until September 2025.

5 Transaction costs presented are indicative only based on the information at 30 June 2024. The fees and costs for subsequent periods will vary depending on the actual fees and costs incurred by the Trustee in managing the investment options. For some options, the Transaction costs you will pay have increased. This is partly due to the removal of Buy-sell spreads for some options. The fees previously collected through the application of Buy-sell spreads were previously offset against Transaction costs.

6 Investment fees and costs are generally calculated using information from the prior financial years, including information on asset allocation and underlying investments. The historic experience for CareSuper is available under the current fees and costs for CareSuper column. To calculate indicative investment fees for the merged fund, which we consider are more reflective of the estimated fees and costs than the historic experience, we’ve used historic information on fees and costs from the underlying investments of CareSuper and Spirit Super as well as strategic asset allocations which will apply from 1 November 2024.

Yes you will receive several pieces of communication from us over this transition period. These will be delivered by mail or email depending on your chosen channel preference.

- The first communication was the Significant Event Notice which you should receive in September.

- Next you will receive a transfer / exit statement which will confirm you super has left the existing super fund. This will be sent in November.

- Finally you will receive a welcome statement which confirms your new account and how it is invested in the merged fund. This will be sent in late November / early December .

There could be changes for you. Your super remains safely invested for your future in your chosen investment options(s) (except for Capital Guaranteed which is moving to the Cash option). Your insurance also will remain if you had any prior to 31 October.

But there are changes to the fund which are confirmed in the Significant Event Notice. These changes are around things like how you make contributions (direct debit will no longer be accepted) and to things like contact centre hours.

There are also some improvements such as your administration fees are decreasing and there are new options for drawing an income in retirement as well as increased ways to get help about your super.

Yes CareSuper will continue to be an industry fund with our focus being on building retirement confidence for our members.

Yes there are changes to pension accounts. These are detailed in your Significant Event Notice and you can watch an overview of the changes here.

Currently, you can nominate the investment option(s) and the method your pension payments are drawn down from your account. The current available methods are percentage, proportionate or sequential.

From 1 November 2024, only the percentage method will be available in the merged fund and your preferences

will be carried across as detailed below:

| Drawdown option | Current | From 1 November 2024 |

| Percentage | Your payment is drawn based on the percentages you have instructed across your investment options. | Your instructions will be continued in the merged fund. |

| Proportionate | Your payment is drawn proportionally from each of your investment options. | You will be moved to the percentage method based on the investment percentages you hold at the time of your first payment. This percentage profile will be used for future payments unless you change it. |

| Sequential | Your payment is drawn in the order you have instructed from your investment options. Once an option is depleted the remaining payment is taken from the next option in the sequence. | You will be moved to the percentage method. Only the first investment option in your sequential instruction will be considered and it will receive an allocation of 100%. This percentage profile will be used for future payments unless you change it. |

| No selection | Default to proportionate. | A percentage profile will be created for you based on the investment percentages you hold at the time of your first payment. This percentage profile will be used for future payments unless you change it |

Each year, you’re legally required to withdraw a minimum amount of pension payments. Your minimum amount will be recalculated based on the balance of your account on 1 November 2024 and as a result, you may see adjustments to the payments you receive.

Your account will be reviewed and assessed to check if the minimum pension payment for the period 1 July – 31 October 2024 will need to be paid to you.

If your account hasn’t met the minimum pro-rated pension payment requirement for this period, a supplementary pro-rata pension payment will be made to you. CareSuper may make adjustments to the payments you receive:

- A pro-rata payment to your nominated bank account to ensure we’ve paid your minimum amount for the period from 1 July 2024 - 31 October 2024

- An adjustment to your payments to ensure you receive the minimum amount for the period from 1 November 2024 - 30 June 2024

If we determine that you will need an additional payment, you will receive it around 22 October 2024.

Payments will be made on the 20th of the month of payment, instead of 22nd of the month.

You can still update how often you want your pension payments to be made. New details below.

| New Frequency | Previous pay day | New pay day |

| Fortnightly | 8th and 22nd day of each month | Every second Thursday commencing 14 November 2024 |

| Monthly | 22nd day of each month | 20th of each month |

| Quarterly | 22nd March, June, September, and December | 20th of every third month |

| Twice-yearly | 22nd June and December | 20th of every sixth month |

| Yearly | 22nd June or the month that you choose | 20th of the month that you choose |

All payment frequencies are staying the same except by-monthly.

The frequency of bi-monthly pension payments will change to fortnightly pension payments in the merged fund. This means instead of receiving 24 payments throughout the year, you will now receive 25 payments throughout the year. Your regular pension payments will change to reflect this additional payment.

| New Frequency | Previous pay day | New pay day |

| Fortnightly | 8th and 22nd day of each month | Every second Thursday commencing 14 November 2024 |

| Monthly | 22nd day of each month | 20th of each month |

| Quarterly | 22nd March, June, September, and December | 20th of every third month |

| Twice-yearly | 22nd June and December | 20th of every sixth month |

| Yearly | 22nd June or the month that you choose | 20th of the month that you choose |

If you have a DIO account on 31 October 2024, any DIO investments you hold will be transferred to the merged fund and will not affect the transfer of your account. We will not sell down your assets to transfer your account.

You will continue to be able to view, access and make changes to your DIO investments in the DIO Online portal, which will be available to you from 21 November 2024.

All eligibility requirements and conditions will remain the same in the merged fund, with the exception of the following changes applicable from 1 November 2024.

| Requirement | Current | From 1 Nov 24 | Impact |

| Account balance for new DIO accounts | At least $10,000 | At least $20,000 | No change for existing DIO account holders |

| Minimum balance in non-DIO investments | The greater of $3,000 or 5% of your account balance | $6,000 | You may be asked after the merger to transfer some money from your DIO to non-DIO options |

| DIO administration fee | $10 per month deducted monthly | $120 per annum deducted monthly, based on the number of days in the month | No change to annual cost, but the monthly fee deducted from your account will be pro-rated across the number of days in the month |

| Annual statement reporting | Includes a detailed list of your holdings and cash hub transactions | Detailed list of holdings and transactions will no longer be included | You will continue to be able to access information via Member Online |

| Manual trading | Accepted | No longer accepted | Only online trading permitted |

From 1 November 2024 the DIO cash account will receive an interest rate of the Reserve Bank of Australia cash rate target less 0.5

If you have a DIO account, there will be a pause in the online service from 22 October 2024 to 21 November 2024. Members won’t be able to access their DIO account or enter transactions (for example, place share trades or switch money in or out of their DIO cash account to another investment option) until Member Online becomes available on 21 November 2024. If you have any unexecuted limit trades on your DIO account, they will be cancelled at market close on 25 October 2024.

From 21 November 2024 Members with a DIO account can trade and transfer money in and out of DIO Cash accounts.