How we outperform over the long term

A bigger super balance means more super to enjoy when you eventually wind down from paid work. Not only does your super balance grow through contributions to your account, investment returns also contribute to growth over time. So, it’s important to ensure that your investment strategy is aligned to your circumstances and that your super fund is a strong, long-term performer.

Key learnings covered in this topic

- How we outperform to grow your super

- What makes our investment philosophy unique

- Importance of focusing on long-term returns

We Outperform and Outprotect

At CareSuper, it’s our investment philosophy that sets us apart from other funds: We aim to Outperform and Outprotect your super. Your super is actively invested, meaning we don’t track indexes (otherwise called ‘passive investing’). Instead, our investment managers search for the best investment opportunities in Australia and overseas and add extra value by choosing specialised investments that we believe have the potential to outperform the market. Our size and agility allow us to build a richer and more diversified investment mix, which, minimises overall risk and ‘smooths out’ the typical highs and lows of the financial markets.

This dual investment approach has driven our award-winning, strong long-term performance for our members, and made us a top-tier platinum fund for over 19 years.We also care about how we invest for your future. Responsible investing is a core part of our investment program and our active management approach enables us to review the environmental, social and governance credentials of every investment to maintain high standards and to ensure we’ll always remain a strong and sustainable super fund.

Importance of long-term outperformance

Your super will remain invested at least until you retire, and perhaps well into your retirement. Therefore, the most crucial factor you should keep front of mind is the importance of adopting a long-term view.

It’s one thing for a super fund to perform well over one year, but strong performance over the long-term is what’s most important and this has a significant impact on your super balance. And if you have time on your side, the more you benefit – largely thanks to the magic of compound interest over time.

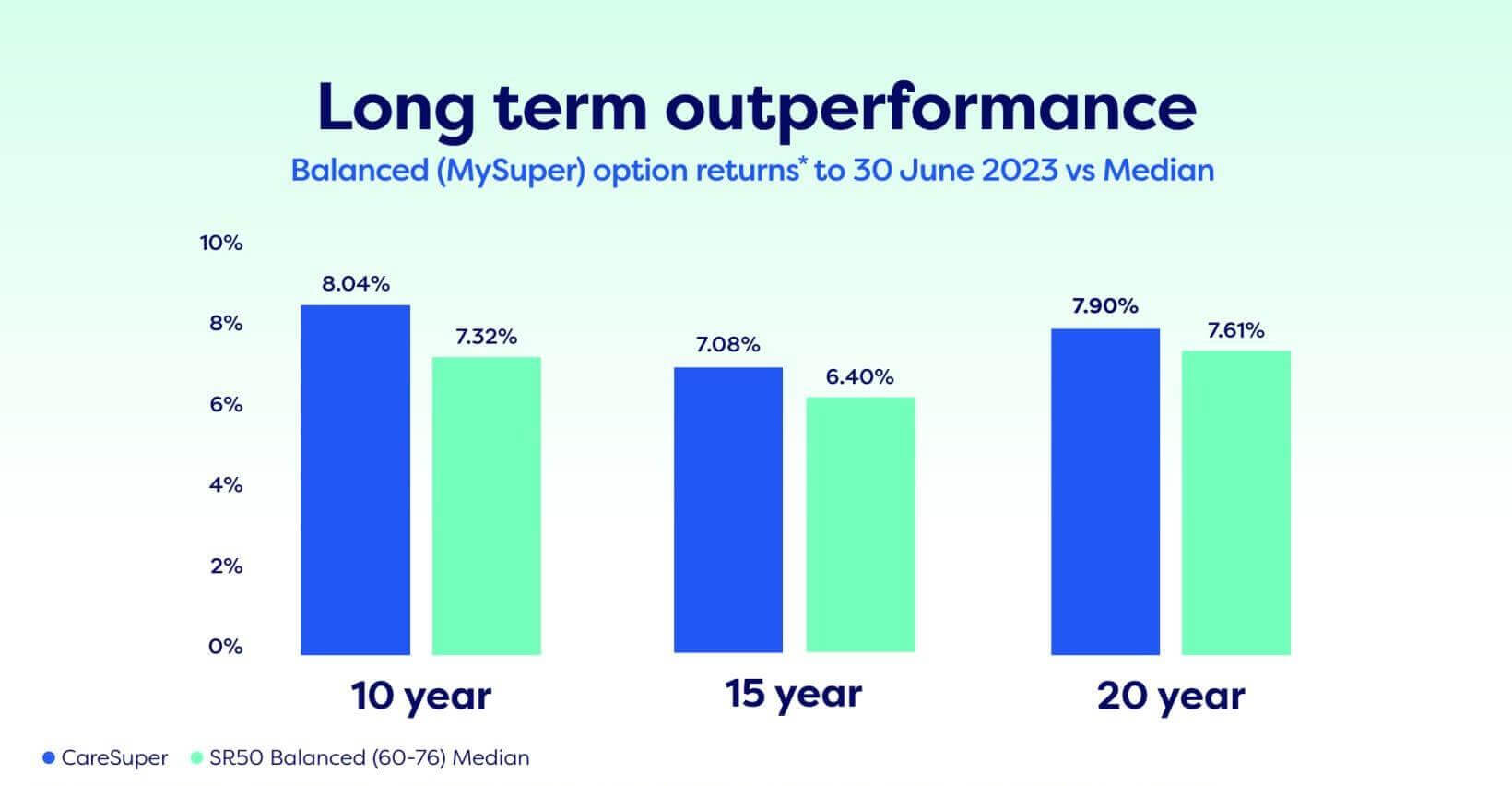

This graph shows CareSuper’s track record of long-term outperformance against the industry median super fund.

*CareSuper's returns are compound average annual returns. CareSuper returns are net of fees and taxes. Returns have been rounded to two decimal places. Source: SuperRatings Fund Crediting Rate Survey - SR50 Balanced (60-76) Index, June 2023. Past performance is not a reliable indicator of future performance and you should consider other factors before choosing a fund or changing your investments.

The result? A bigger net benefit for you

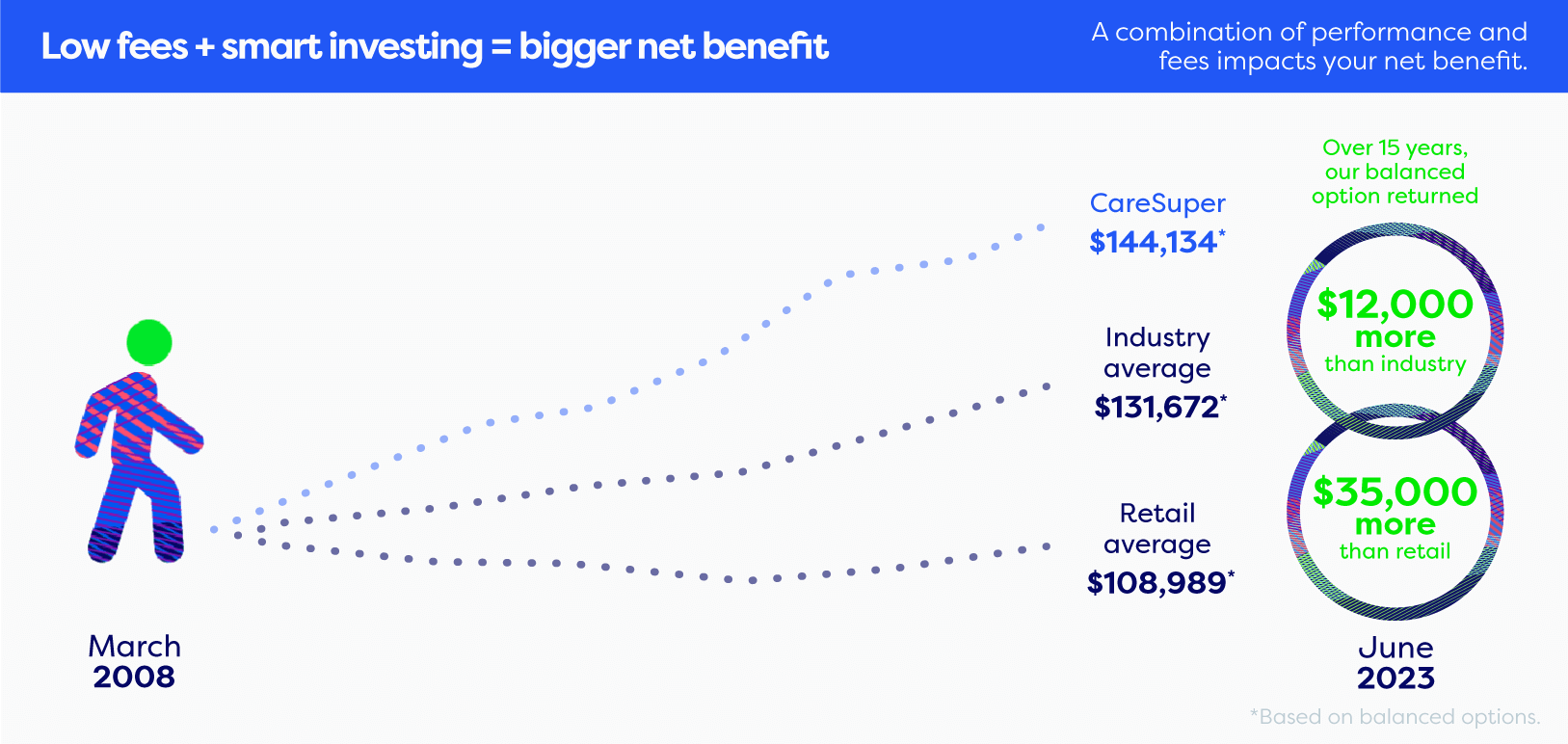

The effect of CareSuper’s competitive fees and outperformance over the long term further demonstrated below in dollar terms. This graph shows the final super balance over 15 years to 30 June 2023 if a member started with $50,000 invested in our Balanced (MySuper) investment option. It compares this balance to the average retail and industry super balanced options.

As shown, our Balanced (MySuper) option returned over $35,000 than the average of all surveyed retail funds and $12,000 more than all surveyed industry funds.*

Review your investment strategy

Making sure your super investment strategy is aligned to your individual circumstances is important to put you in the best financial position for life after work.

Log in to MemberOnline and have a look at the ‘Investments section’ of your account to find out how your super’s invested.

We’re here to help

Unsure if your current investment strategy is right for your circumstances? Good news, you have access to financial advice about your super account at no-extra-cost to you.^ Book an advice call-back, or give us a call.

Interested in learning more about how we invest your super for your future? See how we also outprotect your super.

*Past performance is not a reliable indicator of future performance. Comparisons modelled by SuperRatings as at 30 June 2023, commissioned by CareSuper. Assumes a starting balance of $50,000 and initial salary of $50,000 and considers historical earnings and fees – excluding contributions, entry, exit and adviser fees. Compares the average difference in net benefit performance of CareSuper’s Balanced option and the balanced options of funds tracked by SuperRatings including funds with a 15-year performance history. Outcomes vary between funds. See caresuper.com.au/assumptions for more details about modelling calculations and assumptions. This information is general advice only. You should consider your investment objectives, financial situation and needs and read the product disclosure statement before making an investment decision.

^Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766

Information correct as at 20 October 2023.