Understanding good and bad debt

Debt— it can be a good or a bad thing. While some debt can help you build future wealth, other types can make you feel trapped. So how do you make debt work in your favour and regain control over your financial well-being? Let’s find out.

Key learnings covered in this topic

- Understanding debt

- Breaking bad habits

- Ways CareSuper can help

Understanding good and bad debt

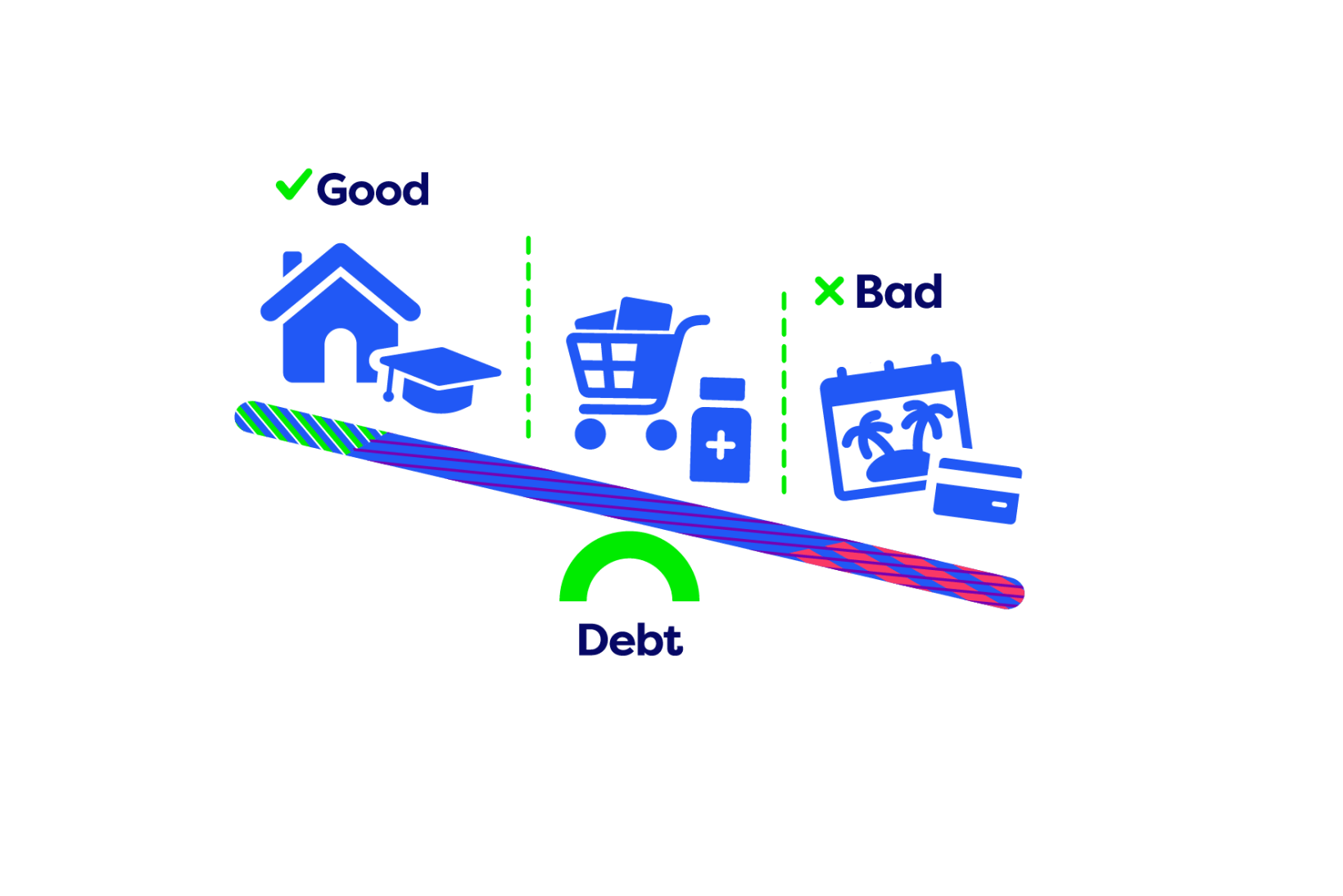

For most people debt forms part of life, but not all debt is the same. The main difference is each financial obligation sits on a scale from necessary to unnecessary.

- Good debt can help you build wealth as its value can grow. Think of your mortgage, an investment loan, small business loan or even your HELP/HECS debt.

- Bad debt can leave you worse off in the long run with purchases quickly depreciating in value. Think of a holiday paid for by taking out a personal loan or using a pay day loan to buy clothes.

- In the middle, is debt that arises from paying for essentials such as unavoidable medical costs, utility bills or groceries. It’s not ‘good’ debt, but it can be necessary debt

Often deciding whether a debt is good or bad depends on your own unique financial situation. But it stands to reason, if the purchase will not help with life’s essentials or provide long-term financial benefit then you can put it in the bad debt category.

How can I clean up my bad debts?

Cleaning up your debt and breaking bad habits can be hard. It won’t happen overnight, but once you’re in control of your finances it can be life changing!

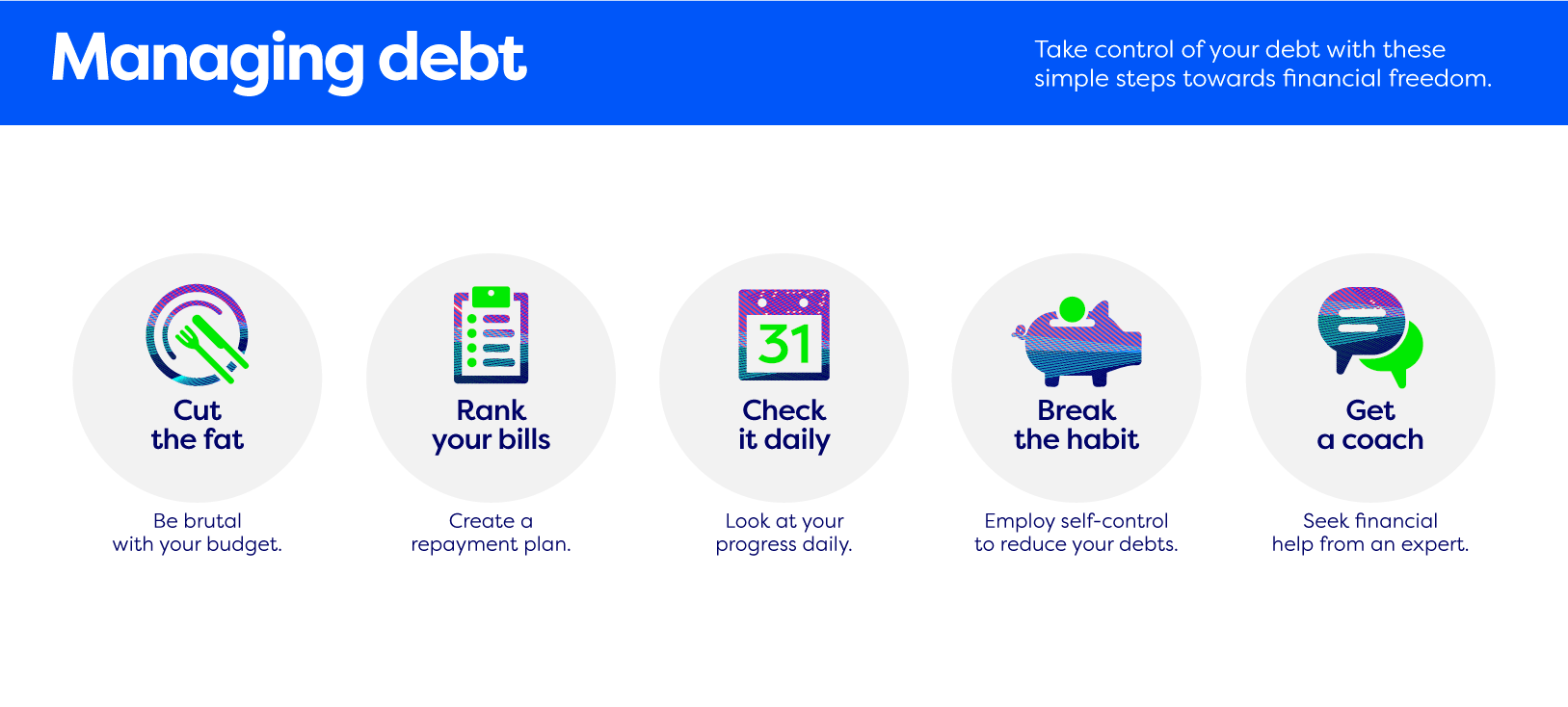

Cut the fat

Be brutal with your budget—where can you cut costs?

Take a look at your bank statements and start tracking expenses. Food delivery for the most part is unnecessary spending. Do you really need to pay to exercise? And can you put a stop to that trip you’re planning? Every little bit counts when reducing debt so even cutting that $10 monthly subscription fee can be worthwhile.

Rank your bills

Once you’ve budgeted, make a list of your outstanding bad debts and create a repayment plan. Clearing smaller debts first could help with motivation, prioritising high-interest debts could reduce your monthly repayments, or consolidation of your debts could be more manageable. Here’s your chance to take control and decide what will clear that debt fastest.

Check it daily

In the first month do daily checks on your progress. Seeing a drop in your debt, even if it’s small, can really give you a boost and reinforce good habits. And when you reach a key milestone, regardless of how small it may seem, celebrate (within budget!).

Break the habit

Reducing your debts requires self-control, especially when it comes to spending on your credit card. If your willpower is lacking, then leave the cards at home and remove the number from any auto pay services like Google. Unsubscribe from all those sales emails you are getting so you aren’t tempted every day. It may sound prehistoric but consider using cash. The physicality of cash makes it more real and therefore harder to spend. It also means you’ll need to plan your online purchases so impulse buys can be minimised.

Get a coach

Managing debt can be challenging, so don’t hesitate to seek financial help from an expert.

Debt counsellors are trained to provide personalised debt strategies, insights into debt consolidation and repayment options, and in many cases, help negotiate with creditors. Many community organisations provide access to experienced counsellors at no cost so there’s no reason to go it alone.

We can help

Creating good money habits can be a life changer. So, once you have your bad debts under control don’t let them rear their ugly head again, instead why not think about ways of saving and creating a nest egg for the future. Building your super balance can be a tax effective way to get started,

Not sure how to kick start your super? We host regular webinars at no extra cost for our members on ways to build your balance and get ahead financially. Have a look at what’s coming up.

Information correct as at 29 November 2023.

*Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766.

^ Advice is provided by one of our financial planners who are Authorised Representatives of Industry Funds Services Limited (IFS). IFS is responsible for any advice given to you by its Authorised Representatives. Industry Fund Services Limited ABN 54 007 016 195 AFSL 232514.