Choose where your super gets invested

Trying to choose an investment option? There’s a bit to consider, so here’s a 5-step guide to help you feel confident about your choice.

Step 1. Get to know the basics

New to investing? Read this page to get an idea of the basics. Then read the FAQs for more details or explanations of confusing terms. For even more information about how CareSuper invests, head over to our Investment Guide or Pension Guide PDS.

Step 2. Decide how hands-on you want to be

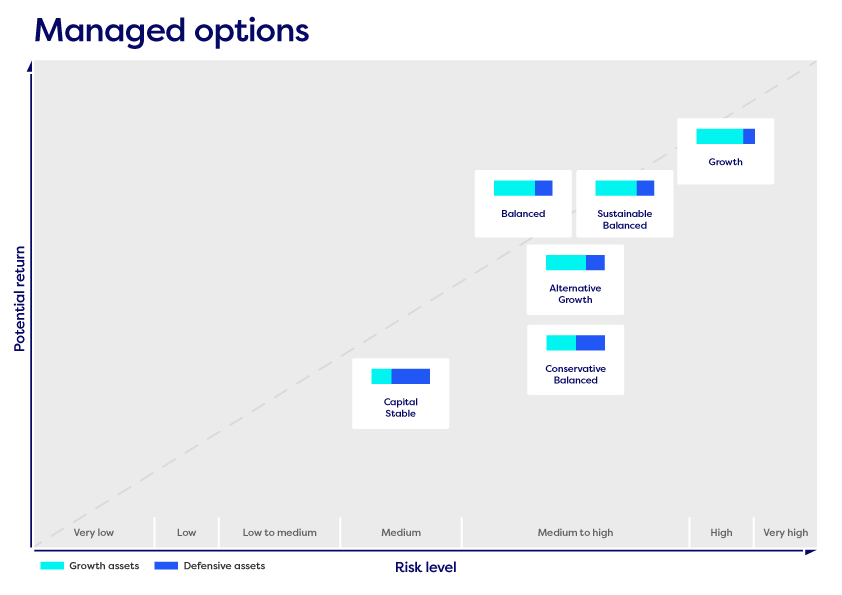

If you’re looking for a low maintenance investment, consider our seven pre-mixed Managed options. We’ve done the work for you by putting together diversified investments across a range of assets, such as shares, property, fixed interest, cash and more.

Prefer to create your own portfolio? No problem, you can mix and match any of our Managed and Asset Class options.

And if you’re seriously hands-on with your investing, use our Direct Investment option to invest part of your super directly in shares, exchange traded funds, listed companies and term deposits.

Step 3. Consider how long you’ll be invested

As a very general rule, the longer your super is going to be invested, the more risk you may be able to take with your investing.

That doesn’t mean you have to suddenly move everything into a low risk option when you hit 60 or 65. If you take up a pension account your super’s likely to stay invested for a long time, even after you stop work.

Remember, you can split your account over more than one option. This may allow you to be more conservative with funds you want to access sooner and invest the rest for a longer time frame.

Knowing how long you’re planning to keep all or some of your super invested can affect the investment choices you make. Each of our investment options lists an investment timeframe and risk level so you can easily compare them.

Step 4. Know how you feel about the risk/return trade-off

Like any investment, super isn’t risk-free.

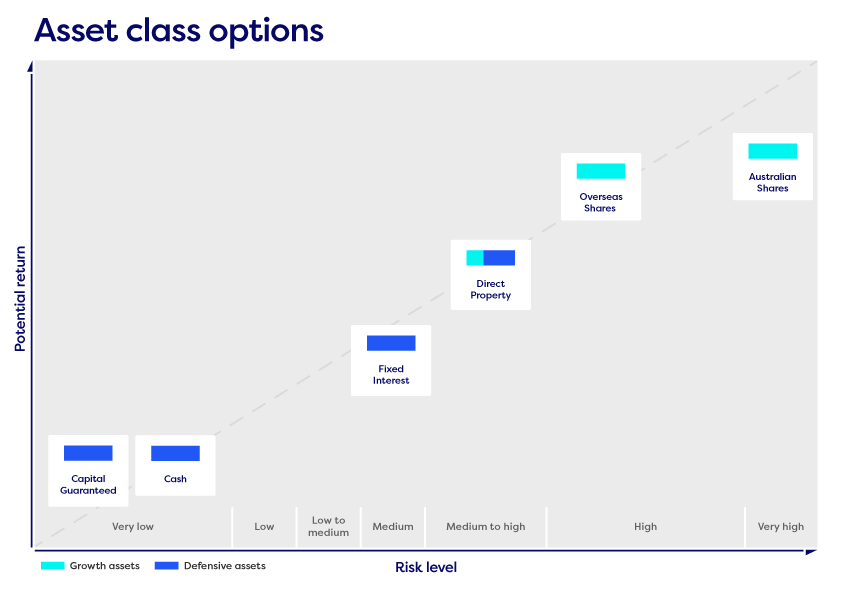

Growth assets, such as shares and property, tend to generate higher returns over the long term, with a greater chance of experiencing negative returns over the short term.

Defensive assets such as cash and fixed interest and other assets used as part of an investment option’s allocation to the Cash or Fixed Interest asset class tend to be more steady and stable, but with lower returns.

You should read your PDS where we explain each asset class in detail and the composition of asset class.

Risk vs Return

The charts below show how our Managed and Asset class options are made up of growth and defensive assets, and the effect these combinations of assets have on the potential for risk and return.

It’s important to know the facts about risk and return before investing your super. While you may have the time to ride out ups and downs, you may still not be comfortable with a higher risk option.

So how much risk should you accept?

The answer is ‘it depends’. It depends on the investment return you’re aiming for, balanced against how much risk you’re comfortable taking and your time frame for investing.

Another factor to consider is any money or assets you have outside super and how they’re invested.

Finally, be aware that there are risks in investing too conservatively. Of which, the main risk is that your money will grow too slowly to meet your financial goals.

Step 5. Tell us your choice

Either log in to your account and change your investments or complete and send us the Investment Choice form. (Excludes the DIO.)

Don’t want to choose? No problem. We’ll invest your super in our default investment strategy, the Balanced option (also known as the MySuper option).

For more information on the options available to you, visit our investment options or download our Investment Guide.

If you’re opening one of our pension accounts, you’ll also need to make an investment choice. You can find out more about this in our Pension Guide PDS.

We're Here to help

Call us on 1300 360 149 for advice on choosing your investments.